You're thinking of getting a home loan? You don't have the funds to pay for moderately priced repairs because some of them have been delayed too long.

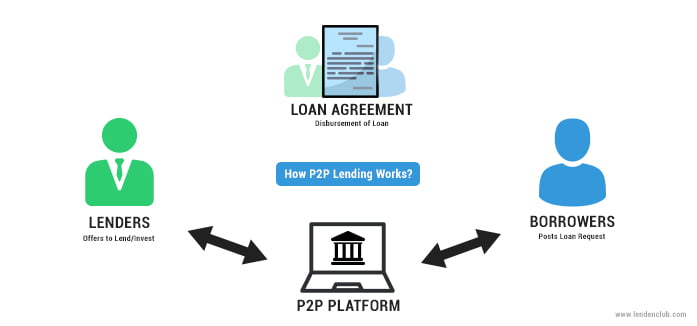

While you can go to your bank or credit union and do the right thing, there might be an alternative. Peer-to-peer credit could be a better option to finance your home line of credit. You can also search for core investment trainings that can be provided by peer-to-peer platforms.

Image Source: Google

Peer-to-peer lending is a tradition that has existed for quite some time. Peer-to-peer lending was less popular before banks became the preferred lending institution. Peer-to-peer lending is again popular because credit is more difficult and even people with exceptional credit ratings have difficulty getting credit.

How can you get your home credit line in this manner? Start by looking at websites. A person in need of a loan applies for funding at different websites. You would then list your home repairs. This information allows you to verify and check your credit. A credit ranking is given to you.

After you have completed all this, people will be able to bid on your project. The interest rate will be lower if you have a good credit score.

The loan must be repaid on a daily basis with monthly payments that are similar to traditional bank loans. Peer-to-peer lending is a good option if you are looking for a home loan.